A few months ago, I wrote a report outlining what I labeled as the “Four Quadrants of MEV Protection” discussing the different approaches to combating the MEV dilemma. Given since publication a lot has changed in the MEV industry, I thought it would be worthwhile to revisit many of the key happenings in the space and to analyze some of the questions and viewpoints on the MEV plate.

For those of you who aren’t familiar with Maximal Extractable Value (MEV) or its key players, I highly recommend you read my previous report before this one as it will be a good introduction to the space. For time purposes, I assume the reader here has proficient MEV and DeFi knowledge. Additionally, unless mentioned otherwise, assume the data and news is regarding the Ethereum network - the main hub for the hungry MEV bots.

As always, nothing I am writing here is financial advice - this is purely my thoughts and research on the innovations in the MEV space. Trust your own instinct and do your own research!

Flashbots: Suave

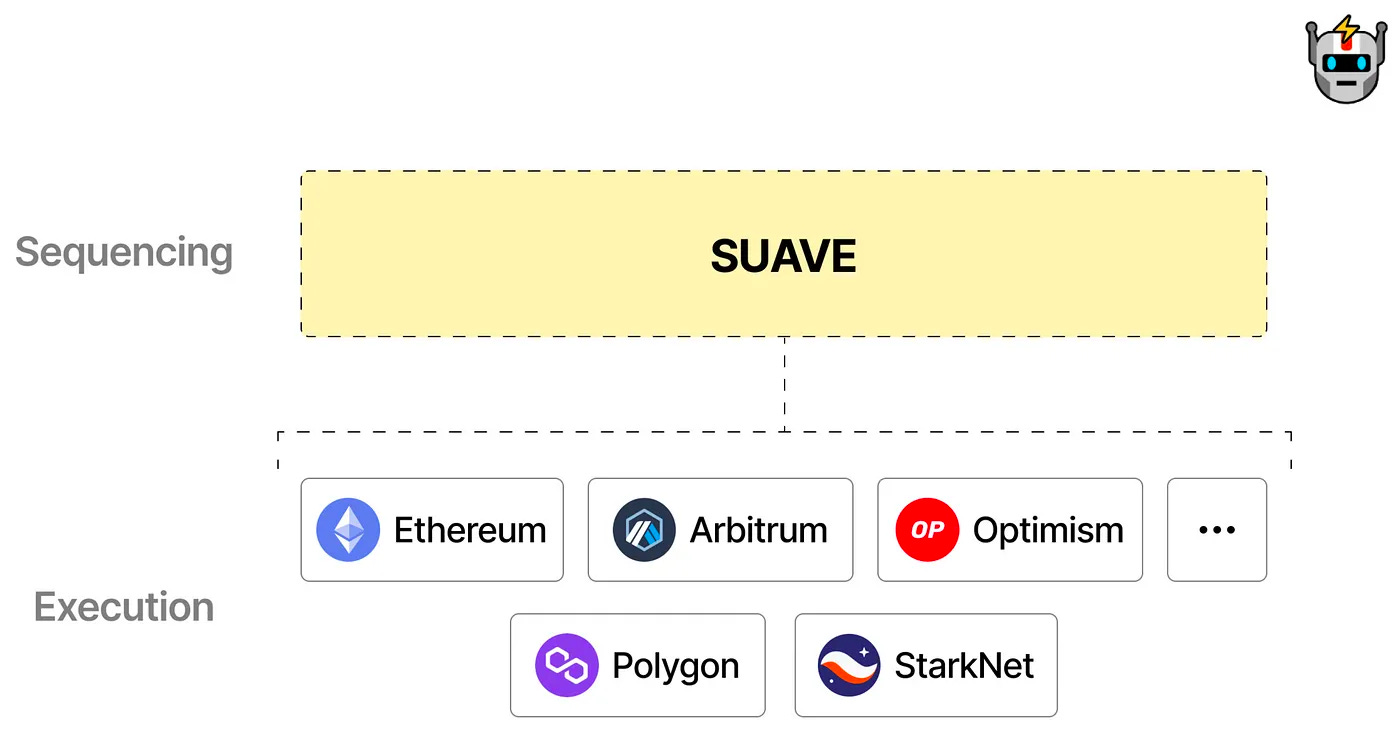

Since last I checked in on the MEV ecosystem, Flashbots had just begun teasing SUAVE, their new solution for MEV. Now that SUAVE is announced, it is imperative to analyze and understand how exactly it works as likely it will be the leading player in the MEV protection space.

Despite Flashbots’ incredible accomplishments with MEV-Boost and MEV-Protect, there were still several concerns regarding centralization in block building, primarily from exclusive orderflow and cross-domain MEV. Thus, Flashbots announced SUAVE — the Single Unified Auction for Value Expression. There were three main values in mind while Flashbots designed it:

Neutralize the pressure from exclusive orderflow

Neutralize the pressure from cross-domain MEV - meaning block builders across chains must integrate with each other in an open, permissionless, and trustless way.

The combination of 1) and 2) must be decentralized itself.

SUAVE, in effect, is a plug-and-play mempool and decentralized block builder for any and all blockchains.

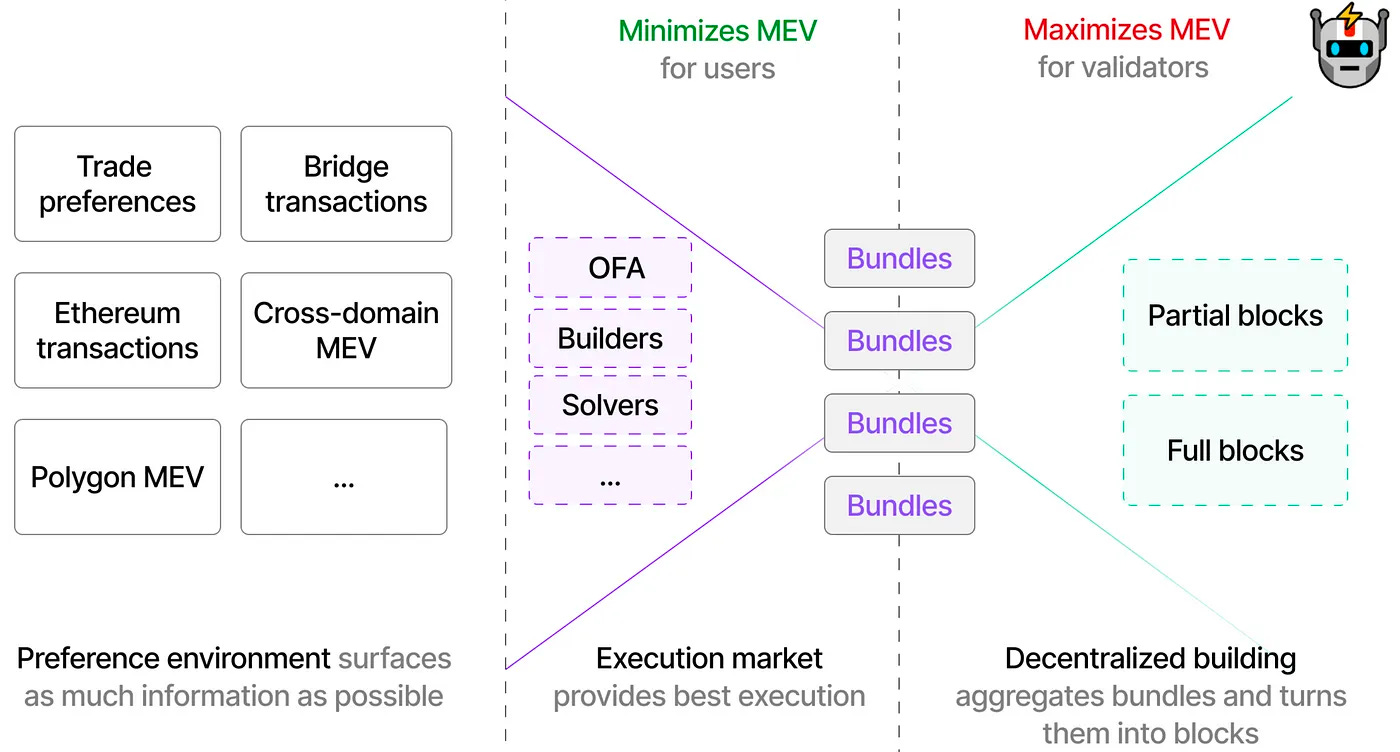

There are three main components to the specialized SUAVE chain, each one corresponding to one of the values outlined earlier: preference environment, execution market, and the decentralized block building. The chain will be EVM-compatible and provide the infrastructure for all these components to interact with each other in a decentralized manner. These three parts each individually take a step forward in minimizing the MEV concerns outlined earlier:

The preference environment solves the cross domain MEV dilemma by surfacing as much information as possible across every chain and form of order flow and minimizes the information gap for all builders.

The execution market solves the exclusive order flow problem by allowing executors to compete to solve the best execution for users preferences. By maximizing competition where anyone can become an executor (builders, RPC service providers, solvers), the hope is the user will receive the most amount of his MEV created.

Finally, the decentralized building creates an ethos of the builders working together by integrating the output of preference environment and execution market. As opposed to block construction by only one builder, this feature aggregates the bundles from the previous step to create the blocks.

To take a deeper dive into SUAVE, I highly recommend reading this for an excellent deeper explanation. Overall, I’m extremely excited for SUAVE as it will create a new paradigm in MEV. As opposed to the former centralized bizarre we had, a new era of balanced competition and MEV fairness has arrived.

Other Flashbots Developments

In addition to SUAVE, Flashbots and its ecosystem partners have recently announced a variety of other incredible features and products dedicated to MEV protection. Just recently, MEV-Boost payments hit an all time high hitting 7691 ETH paid to MEV-Boost proposers, nearly doubling the previous all time high. Nearly 95% of blocks that day were MEV-Boosted blocks as well. Additionally, the announcement of MEV-Share which will build on MEV-Boost should assist users and applications receive the MEV their transactions create while giving searchers and block builders additional benefits and profit.

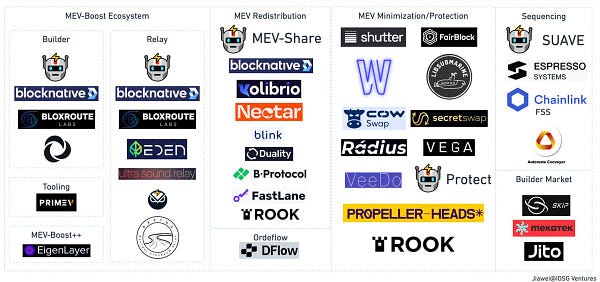

Flashbots is always ahead of the pack in MEV protection, and it is vital to view their focuses to understand the key problems and directions the industry is heading. As the tweet below shows, Flashbots is a major player in practically all forms of MEV protection - kudos to them! I look forward to seeing what other terrific products they put out.

What else is going on in the consensus layer?

Other than Flashbots, there are a variety of other eye-opening developments happening in the consensus layer. In this section, I aim to do a quick overview of some of the recent innovations and discussions, although my summaries certainly won’t do the immense and valuable material justice. I encourage the reader to dig further into the links provided to understand the intricacies of this landscape.

Block Building

First and foremost, the discussion every MEV enthusiast is most enthralled in is the the next steps for block building on Ethereum. Block building is how blocks are externally built through MEV-Boost which separates the block builder from the validator. While originally (right after the merge) almost completely dominated by Flashbots, block building has decentralized a bit since, where now Flashbots only encompasses around 20% of the block building market.

Now, the question remaining is what is in store for block building? A recent report by Frontier Research suggested several pretty cool ideas, namely block builders bundling other products within themselves and even begin offering services. By bundling other products, there can be innovations across gas frictions, transaction execution, and even runtime monitoring to ensure transactions with expected outcomes are included in the block. By beginning to offer services as abstractors, there will be imminent integrations and internal products with the cross-chain future, block customization, and certainly a variety of MEV smoothing. This was a pretty fascinating article to read, and I highly recommend those interested in block building and consensus layer innovations to read it.

Mempools

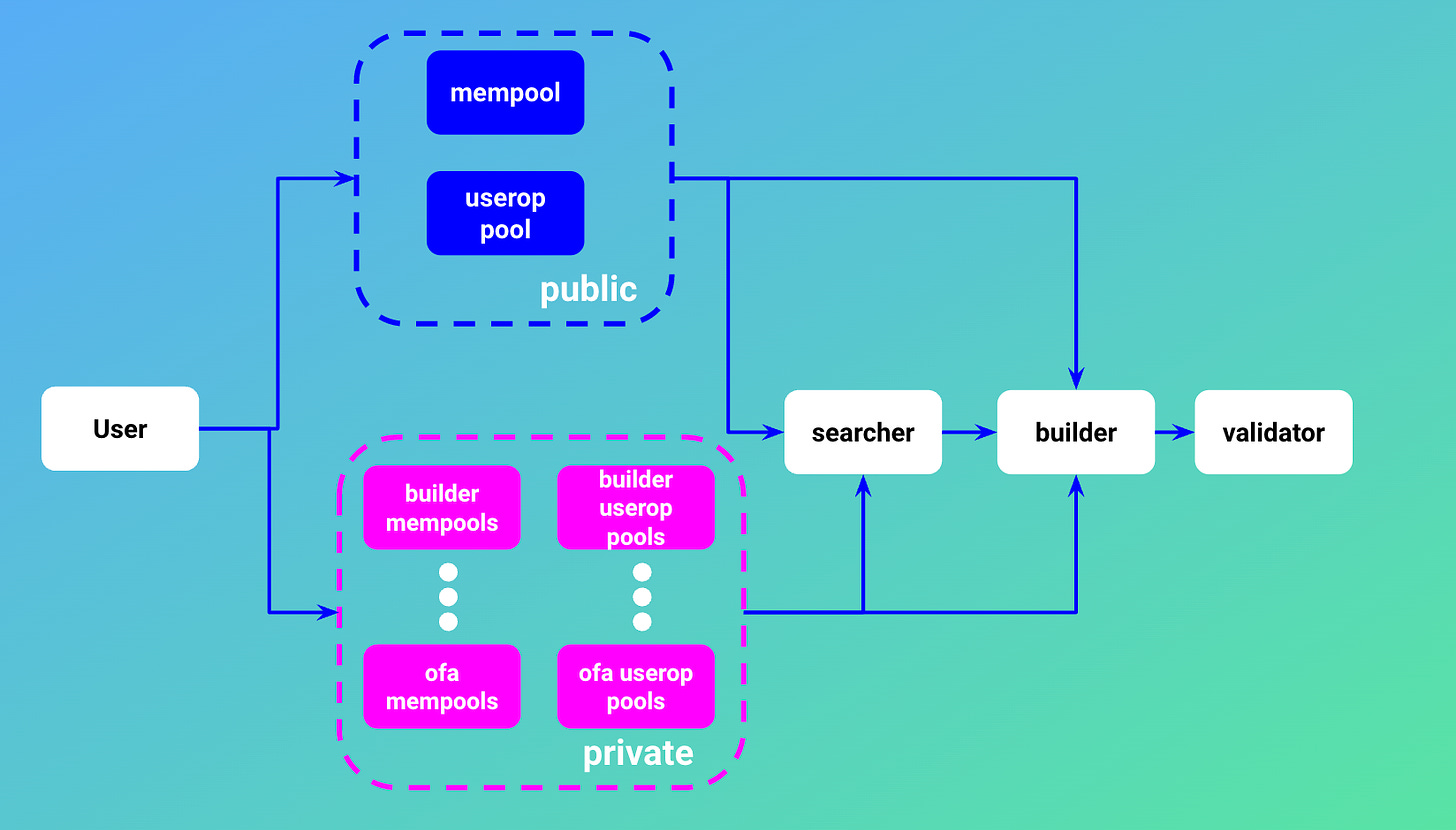

Another discussion occurring right now is how we perceive mempools and how to make them more efficient. Usually the root of all MEV conflicts, mempools have been a touchy and complicated topic across most blockchain communities for some time now. Although at first glance a potential way of smoothing MEV is with encrypted mempools, there are a variety of other questions how it would practically play out. Jon Charonneau does an excellent job in this article explaining how an encrypted mempool would functionally look like. For those of you who want a simpler explanation, here is a great tweet thread on the matter.

A hot topic right now regarding the mempool is ERC-4337. Although mainly revolving around account abstraction (which is a completely different article for another time), the main change ERC-4337 is bringing is that now users will be able to interact on an alternate “user operation” mempool. Here is a great article on what the next steps are for the MEV supply chain with ERC-4337.

Sei and Dividing MEV Externalities

To touch upon this point briefly, a new focus of some blockchains is to become specialized and sector specific chains. One of these is Sei, which is a layer-1 specialized for trading. Although the discussion of sector-specific chains is one for another time, Sei has a pretty cool approach for how they are tackling MEV. As we’ve discussed many times, there are both positive and negative consequences to MEV. Frontrunning and validator level MEV is clearly net-negative to the chain, whereas arbitrage and liquidation MEV can have a meaningful argument the other way. Sei realizes this, so instead of eradicating MEV completely, they have two different approaches for how they are handling the issue. To maximize good MEV, Sei is using an “off-chain Flashbots style auction.” Although that is interesting in its own right, the way Sei is approaching bad MEV is quite cool. Sei is using a form of frequent batch auctions with an advanced and completely native order matching engine (OME) that aggregates every single market order at the end of the block, then executes all orders at the same uniform clearing price. Meaning regardless of the order of the transaction, everyone in that block (around 450 ms) gets the same price. Sei’s approach of dividing the different forms of MEV and conquering it in separate ways is an idea I hope to see other blockchains and applications attempt as well.

Skip Protocol

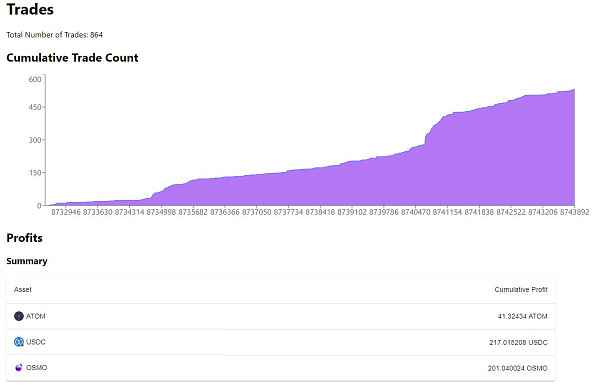

One of my favorite MEV defendants is Skip Protocol, an infrastructure builder for sovereign blockchains on the Cosmos ecosystem. They have quite a variety of products, ranging from Skip Select (a blockchain auction system allowing searchers to capture MEV), to Skip Secure (a private RPC endpoint allowing anyone who adds it to their wallets to have private transactions). Recently, they launched ProtoRev, an on-chain module on Osmosis immediately backrunning transactions at execution time, thus capturing that MEV and sharing it with its users.

However, most recently (and what I’m most excited about), they announced they are working on Protocol-Owned Builders (POB), their counterattack to Ethereum’s proposer-builder separation (PBS) plan. By implementing POB, it’ll prevent builder centralization by minimizing private orderflow and will remove complete dependencies on off-chain builders. All the MEV recapture will be inside the protocol and will allow chains to completely customize their mempools and preferences. Overall, Skip does really great work for the Cosmos ecosystem and I am certainly keeping my eye out on them as they launch incredible products seemingly almost weekly.

Application MEV Protection

In my previous MEV report, I discussed there were two distinct camps in the form of MEV protection: those attempting to catch in on the consensus or protocol layer, and those attempting to minimize or completely eradicate it on the application layer. Since I published my last report, there have been two application announcements that have caught my attention.

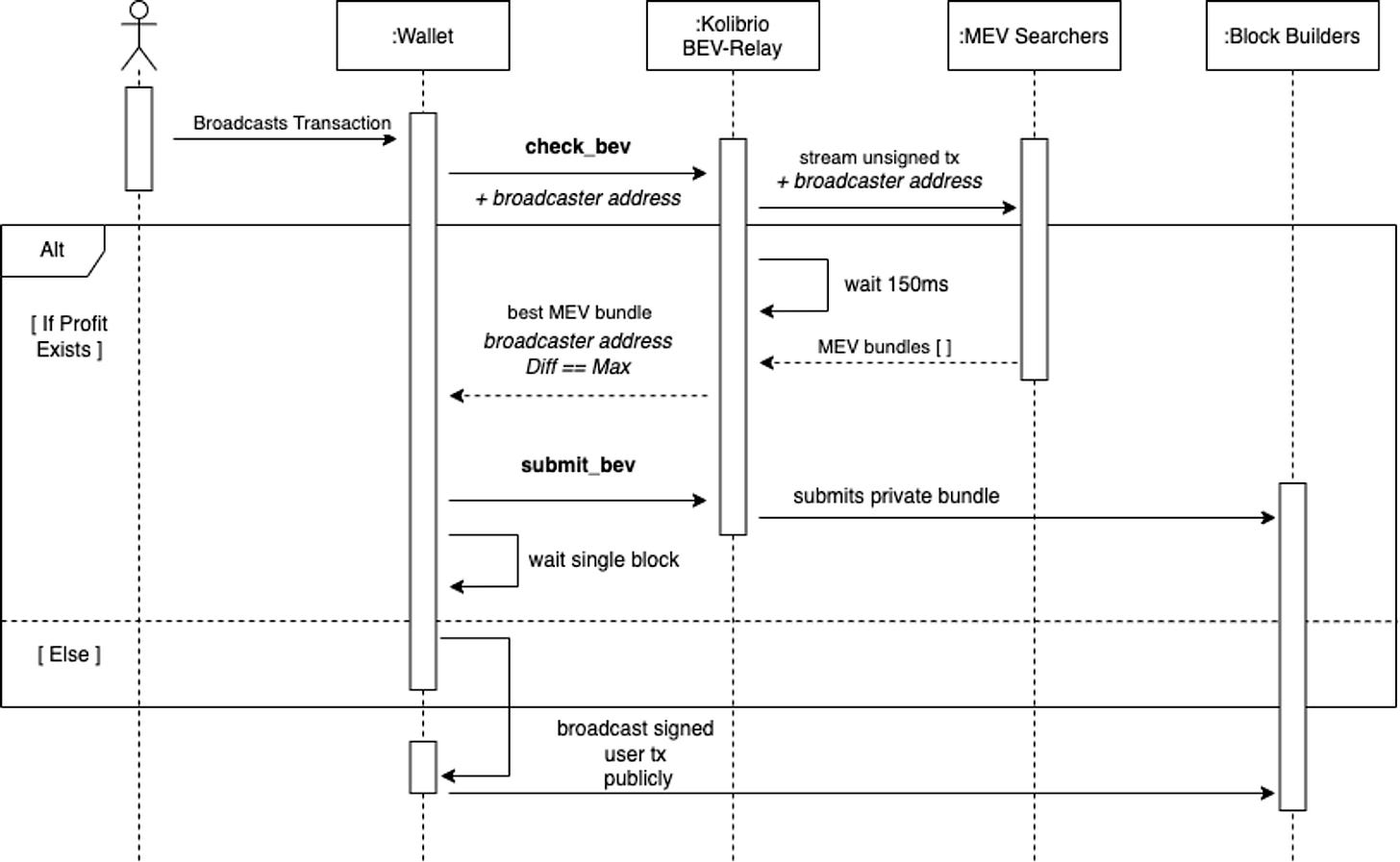

The first application that caught my eye is Kolibrio, the first BEV (Broadcaster Extractable Value) Relay. By allowing transaction broadcasters (think node providers, wallets, bridges, and even Dapps and protocols in the future) to own their orderflow they create and monetize it. Without going into too much detail, the Kolibrio BEV Relay checks every transaction for potential MEV profit prior to them appearing in the public mempool. If there is MEV profit, then the transaction is delayed by a block or so, while the transaction is mined privately as a MEV bundle.

I expect this new type of relay to allow redistributing of MEV profits and further advance the MEV democratization trend. Those of you interested in how this works further in depth, their documentation does a pretty good job at explaining what the mission is.

Another application that I found quite interesting and untraditional is PropellerHeads. Although they have very little public information on how exactly their StabilityKeepers work, their deployment on ZKSync is certainly notable. Additionally, something I haven’t seen before until now in the blockchain space, or any alternative assets to be frank, is the opportunity to invest in MEV bots. I thought that was pretty unique (not financial advice). I’m looking forward to PropellerHeads publish more information on how exactly their keepers work, ideally in the near future.

Other Miscellaneous MEV Happenings

A recent Flashbots publication argues not only technological decentralization is vital, but also geographic decentralization to prevent bias against one region or its regulation, and to create a truly global system. Although this isn’t as applicable in the MEV discussion, it is referenced in a fascinating research paper regarding MEV on Ethereum Policy Analysis. If states were to ultimately begin outlawing or creating unwelcoming policy for MEV searchers of validators, Mikolaj Barczentewicz argues, then more lenient jurisdictions would end up absorbing these players, thus minimizing geographic decentralization. Regardless, understanding exactly which forms of MEV are legal or not (because some even have benefits to their users), is a first step.

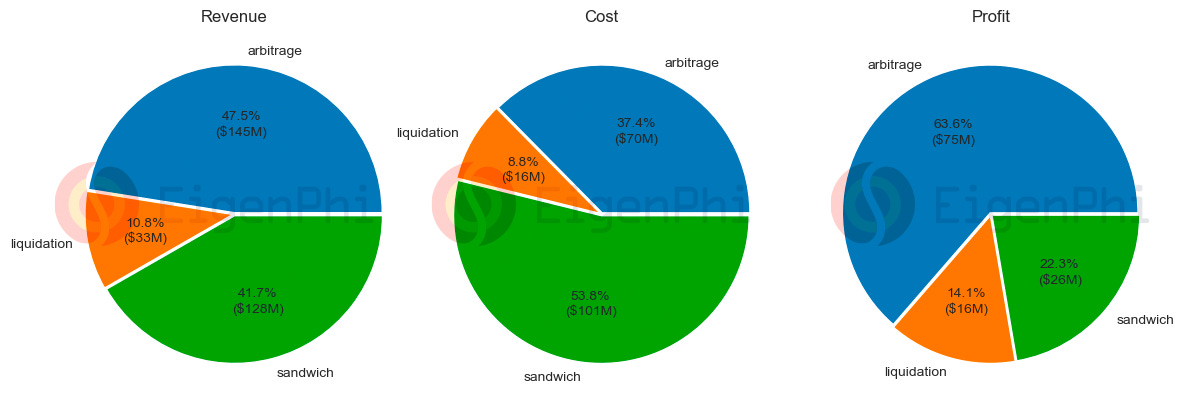

Another fascinating trend in the MEV space is the moat arbitrage transactions have compared to other MEV types. In a recent report by EigenPhi, they outline that arbitrage plays are nearly half (47.5%) of MEV transactions while being the most frequent (63.8%) opportunities as well. It is certainly expected that arbitrage will continue being the dominant form of MEV, and rightfully so as many DeFi protocols rely on it to operate. However, arbitrage does create some centralization concerns, especially on Ethereum. The top ten arbitrage bots on Ethereum comprised 51.3% of MEV profit share, while BNB chain’s more welcoming and likely less penetrated environment allowed the top ten bots only to comprise 25% of MEV profit share. As BNB chain continues to advance and grow their DeFi positioning, I expect MEV competition to grow significantly there.

Shrine of MEV Transactions

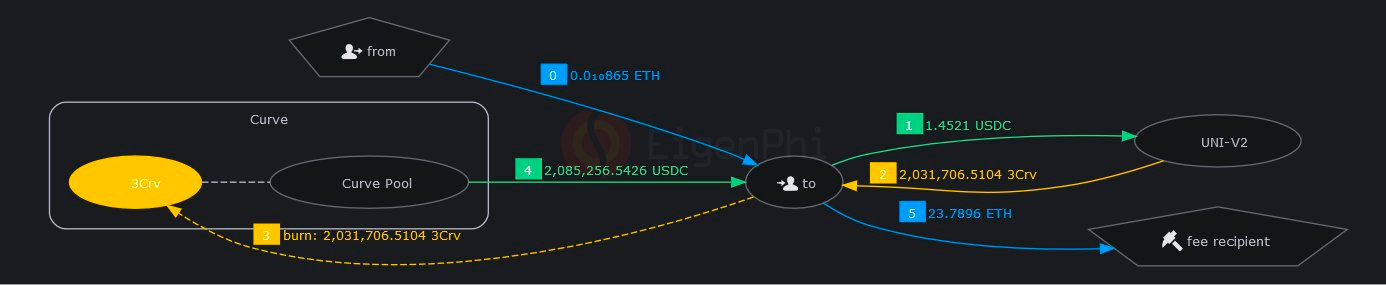

There have been some MEV plays recently that are also worthwhile to look at to understand how the professional bots are playing and to understand how you can best protect yourself. Just last week, during the Silicon Valley Bank debacle, USDC slightly depegged, creating fears throughout the DeFi community. While users were fleeing to safety in other stablecoins, sadly one user got slaughtered during his exchange - trading $2.08M 3CRV to receive $0.05 of USDT, an absolutely awful scenario. The lucky MEV bot in this case paid $45 in gas and $39k in MEV bribes, netting $2.045M in profit.

There are several lessons to take away from this. First of all, the user needed to be more vigilant with his transaction. Clearly, the slippage was not set, and clearly, the user did not know he could have just exchanged his 3CRV token into USDT with just 6% slippage. Secondly, Kyber Network had a dead Uniswap V2 pool on its aggregator, a clear red flag. Third, why did more MEV bots not attack this! Sometimes the efficiency (or inefficiencies in this case) of the market are wondrous to look at.

Another cool MEV play I’d like to share is when an arb bot sandwiched 56 transactions in one block! I don’t know what exactly to make of this, but regardless it's pretty cool to see and analyze. Lastly, here is the most profitable MEV play in modern history - fascinating to see it in a simple MEV trade.

Final Thoughts

As we’ve seen, nearly every week there are incredible innovations in the MEV space. I hope this brief write up showed you some of the trends, discussions, and notable news happening before our very eyes. Some of the open questions I'm personally keeping an eye out for are how block builders will continue to grow with more functionality, the evolution of mempools, and how different MEV possibilities arrive with new variations of DeFi, specialty chains, and their derivatives. Lastly, the trend of eliminating, smoothing, or democratizing MEV is as strong as ever, and I expect it to only grow as the industry picks up more interest.

My goal is to make my fellow on-chain finance users aware of these externalities and to ensure the community knows some of the strategies, tools, and protocols taking shape to prevent a scary and worse future with the hungry arbitrage bots. After you read this, I hope I did exactly that.

This amazing stuff mate.

very resourceful for folks building new mev products.

This is a special request - to do a piece on MEV capturing amm - if you ever come across this comment...kek.